Ai Group monitors and analyses developments across the Australian economy. We produce a range of regular activity indicators, reports, submissions and research notes about issues that affect Australian business and industry.

The Ai Group Australian Industry Index® is representative of the modern industrial ecosystem. It brings together the manufacturing, construction, engineering, technology and business services sectors – industries which together account for 36% of the Australian economy.

Recognising the heritage and importance of the Australian PMI® and Australia PCI®, both will continue as sub-indicators available within the Ai Group Australian Industry Index®, however, there will no longer be separate release dates for these indexes.

The Ai Group Australian Industry Index® is regularly published on the first working Wednesday of each month (or the following working day if the Wednesday is a national holiday): Australian Industry Index release dates 2024

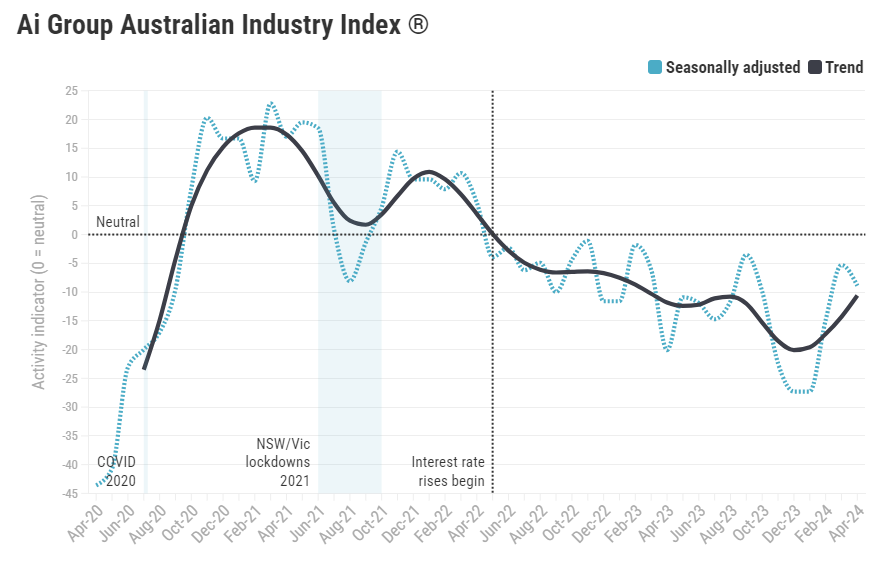

The Ai Group Australian Industry Index® fell in April 2024, losing 3.6 points to -8.9 points (seasonally adjusted). The index has indicated contractionary conditions for the last twenty-four months.

In the April edition of Economic Intelligence we cover:

Our reports and time series data for the Ai Group Australian Industry Index® are available free of charge to Ai Group members at any time via email from our economics research team economics@aigroup.com.au. Our data are available to non-members on an annual subscription basis or a one-off purchase. Our data subscribers receive the report and time series data for the activity index, sector and selected states via email each month.

The Workplace Advice Line is Ai Group’s national telephone advisory service for all your on the spot workplace related questions.

Call the Workplace Advice Line

1300 55 66 77 and press option 1

(Overseas: +61 3 9867 0100). Email: workplaceadvice@aigroup.com.au

Weekdays from 8.30am to 5.30pm

(Australian Eastern Daylight/Standard Time)

Want to get in touch? We'd love to hear from you.